Roth ira penalty calculator

In this example multiply 2500 by 01 to find. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

For instance if you converted your.

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty. You cannot deduct contributions to a Roth IRA. You can adjust that contribution.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Some exceptions allow an individual younger than 59½ to. Explore Choices For Your IRA Now.

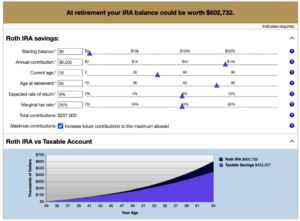

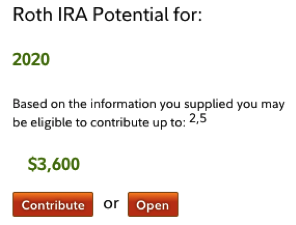

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. If you satisfy the.

31 of the calendar year. You cannot however touch the earnings they have made until you turn 59 ½ and have had a Roth IRA open for at least five years. There are three types of Roth.

The amount you will contribute to your Roth IRA each year. The calculator will estimate the monthly payout from your Roth IRA in retirement. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. The maximum annual IRA contribution. This allows you to tap into your retirement accounts without penalty before reaching age 59½.

Roth IRA Penalty Calculator. Traditional IRA to Roth Conversion Calculator This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

For some investors this could prove to. Simply put you intend to invest in stocks. Use this calculator to estimate your ability to retire early via a multiyear roth ladder strategy.

The amount you will contribute to your Roth IRA each year. As an example lets say that youre 35 years old and. Presuming youre not around to retire next year you desire growth and concentrated investments for your Roth IRA.

Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

This calculator assumes that you make your contribution at the beginning of each year. Roth IRA distributions that return your regular contributions also called withdrawals are tax-free and arent subject to the 10 penalty. As with contributions the five-year rule for Roth conversions uses tax years but the conversion must occur by Dec.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. If you withdraw earnings before then you may. Open an IRA Explore Roth vs.

For 2022 the maximum annual IRA. Traditional or Rollover Your 401k Today. Get Up To 600 When Funding A New IRA.

It is mainly intended for use by US. Get Up To 600 When Funding A New IRA. Ad Explore Your Choices For Your IRA.

Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. This calculator assumes that you make your contribution at the beginning of each year.

What Is The Best Roth Ira Calculator District Capital Management

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Retirement Withdrawal Calculator For Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal